DOWNERS GROVE, Ill., October 24, 2023 /PRNewswire/ — Dover (NYSE: DOV), a diversified global manufacturer, announced its financial results for the third quarter ended September 30, 2023. All comparisons are to the comparable period of the prior fiscal year, unless otherwise noted.

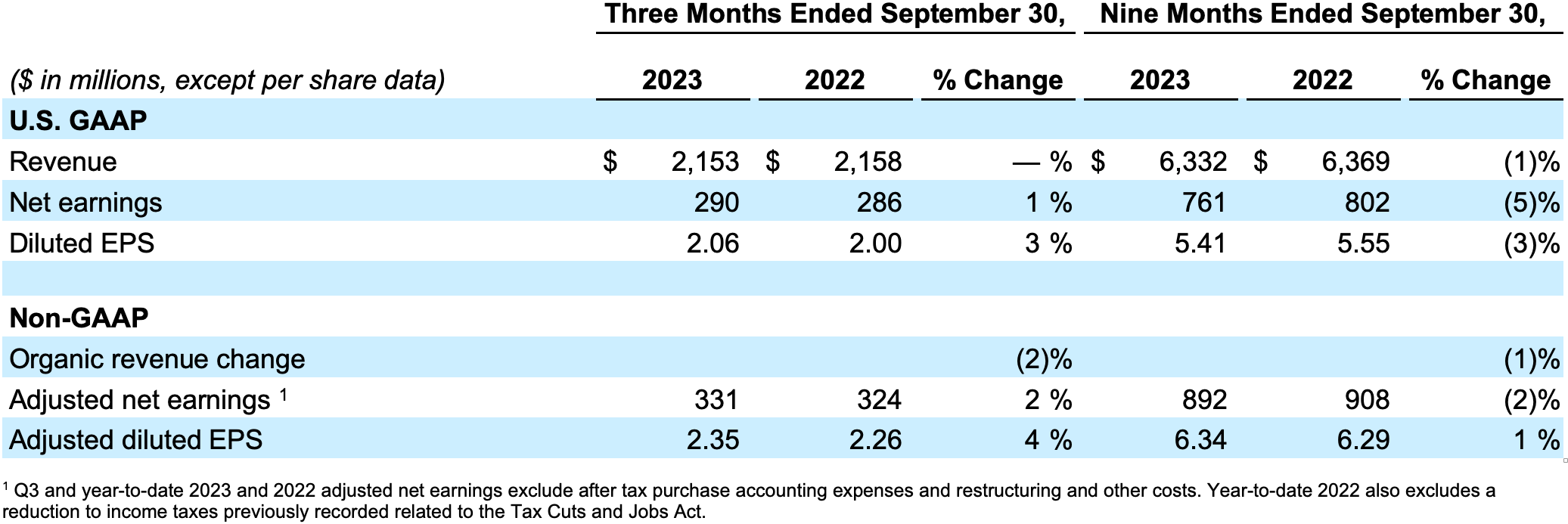

For the quarter ended September 30, 2023, Dover generated revenue of $2.2 billion, in line with the prior year (-2% organic). GAAP net earnings of $290 million increased 1%, and GAAP diluted EPS of $2.06 was up 3%. On an adjusted basis, net earnings of $331 million increased 2% and adjusted diluted EPS of $2.35 was up 4%.

For the nine months ended September 30, 2023, Dover generated revenue of $6.3 billion, a decrease of 1% (-1% organic). GAAP net earnings of $761 million decreased 5%, and GAAP diluted EPS of $5.41 was down 3%. On an adjusted basis, net earnings of $892 million decreased 2%, and adjusted diluted EPS of $6.34 was up 1%.

A full reconciliation between GAAP and adjusted measures and definitions of non-GAAP and other performance measures are included as an exhibit herein.

MANAGEMENT COMMENTARY:

Dover's President and Chief Executive Officer, Richard J. Tobin, said, "The third quarter results were encouraging. We are especially proud of our margin performance as we offset negative product mix with productivity and disciplined pricing. We are well on our way to delivering on our margin targets outlined during the investor and analyst meeting last March.

“Revenue and order rates improved sequentially in the quarter on improving activity across several end markets and a return to normal seasonality after several years of disruptions from the pandemic and follow-on supply chain issues. Our backlog continued to normalize in the quarter in tandem with lead times as we shipped longer-dated orders from our books.

“Consolidated segment margin reached a record-high level in the quarter, driven by cost containment actions and solid execution by our operating teams. The proactive structural cost reductions we implemented over the last twelve months are paying off and set a foundation for continued robust margin conversion.

“Our two recent portfolio moves—the acquisition of FW Murphy and the sale of De-Sta-Co—continued our portfolio evolution towards higher-growth and higher-return businesses at attractive valuations. These moves clearly follow the portfolio intent and priorities that we reiterated at our investor day earlier this year. Our balance sheet position and cash flow are strong and provide attractive optionality as we continue to pursue bolt-on acquisitions and opportunistic capital return strategies.

“While we are encouraged by the overall trajectory of the portfolio, we are shifting to a more conservative outlook for the remainder of the year to reflect the changes in certain market conditions we observed in the third quarter. We expect biopharma demand and automotive production curtailment to be headwinds for the balance of the year. The higher carrying costs of channel inventory driven by higher interest rates will continue to weigh on near-term volumes in several end markets, and we will be absorbing elevated transaction and integration costs in the fourth quarter related to our recent and ongoing deal activity. Our channel checks indicate that inventories are close to balancing, and as such we aim to optimize pricing, margin, and cash flow generation instead of maximizing volume in the fourth quarter to set up a solid foundation for organic growth and margin accretion in 2024.”

FULL YEAR 2023 GUIDANCE:

In 2023, Dover expects to generate GAAP EPS in the range of $7.51 to $7.61 (adjusted EPS of $8.75 to $8.85), based on approximately flat full year revenue growth (all-in and organic).

CONFERENCE CALL INFORMATION:

Dover will host a webcast and conference call to discuss its third quarter and year-to-date results at 10:00 A.M. Eastern Time (9:00 A.M. Central Time) on Tuesday, October 24, 2023. The webcast can be accessed on the Dover website at dovercorporation.com. The conference call will also be made available for replay on the website. Additional information on Dover's results and its operating segments can be found on the Company's website.

ABOUT DOVER:

Dover is a diversified global manufacturer and solutions provider with annual revenue of over $8 billion. We deliver innovative equipment and components, consumable supplies, aftermarket parts, software and digital solutions, and support services through five operating segments: Engineered Products, Clean Energy & Fueling, Imaging & Identification, Pumps & Process Solutions and Climate & Sustainability Technologies. Dover combines global scale with operational agility to lead the markets we serve. Recognized for our entrepreneurial approach for over 65 years, our team of over 25,000 employees takes an ownership mindset, collaborating with customers to redefine what's possible. Headquartered in Downers Grove, Illinois, Dover trades on the New York Stock Exchange under "DOV."

FORWARD-LOOKING STATEMENTS:

This press release contains "forward-looking" statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. All statements in this document other than statements of historical fact are statements that are, or could be deemed, "forward-looking" statements. Forward-looking statements are subject to numerous important risks, uncertainties, assumptions and other factors, some of which are beyond the Company's control. Factors that could cause actual results to differ materially from current expectations include, among other things, general economic conditions and conditions in the particular markets in which we operate, supply chain constraints and labor shortages that could result in production stoppages, inflation in material input costs and freight logistics, the impact of interest rate and currency exchange rate fluctuations, the impacts of COVID-19, or other future pandemics, on the global economy and on our customers, suppliers, employees, business and cash flows, the impact on global or a regional economy due to the outbreak or escalation of hostilities or war, changes in customer demand and capital spending, competitive factors and pricing pressures, our ability to develop and launch new products in a cost-effective manner, our ability to realize synergies from newly acquired businesses, and our ability to derive expected benefits from restructuring, productivity initiatives and other cost reduction actions. For details on the risks and uncertainties that could cause our results to differ materially from the forward-looking statements contained herein, we refer you to the documents we file with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the year ended December 31, 2022, and our Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. These documents are available from the Securities and Exchange Commission, and on our website, dovercorporation.com. The Company undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise.