DOWNERS GROVE, Ill., January 30, 2025 /PRNewswire/ — Dover (NYSE: DOV), a diversified global manufacturer, announced its financial results for the fourth quarter and full year ended December 31, 2024. All comparisons are to the comparable period of the prior fiscal year, unless otherwise noted.

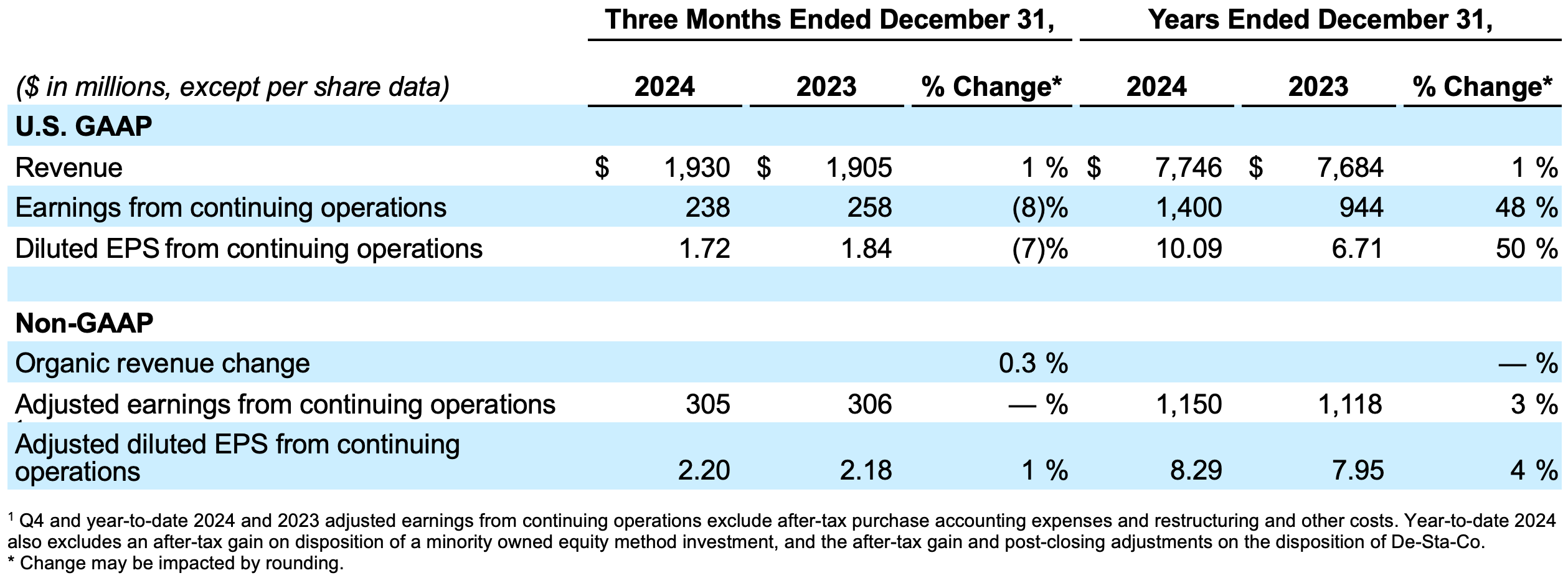

For the quarter ended December 31, 2024, Dover generated revenue of $1.9 billion, an increase of 1%. GAAP earnings from continuing operations of $238 million decreased 8%, and GAAP diluted EPS from continuing operations of $1.72 was down 7%. On an adjusted basis, earnings from continuing operations of $305 million remained flat and adjusted diluted EPS from continuing operations of $2.20 was up 1%.

For the year ended December 31, 2024, Dover generated revenue of $7.7 billion, an increase of 1% compared to the prior year. GAAP earnings from continuing operations of $1.4 billion increased by 48%, and GAAP diluted EPS from continuing operations of $10.09 was up 50%. On an adjusted basis, earnings from continuing operations of $1.2 billion increased 3%, and adjusted diluted EPS from continuing operations of $8.29 was up 4% compared to the prior year.

A full reconciliation between GAAP and adjusted measures and definitions of non-GAAP and other performance measures are included as an exhibit herein.

MANAGEMENT COMMENTARY:

Dover's President and Chief Executive Officer, Richard J. Tobin, said, "Dover’s fourth quarter results were very encouraging as we move into 2025, with broad-based top line strength across the portfolio and particularly robust performances within the Clean Energy & Fueling and Pumps & Process Solutions segments. Order trends continued their positive trajectory in the quarter with book-to-bill above one, driven by robust bookings in our secular-growth-exposed markets in single-use biopharma components, thermal connectors, and CO2 systems.

"Margin improvement was solid during the period due to the positive mix impact from our high margin, high growth platforms, and our rigorous cost containment and productivity actions. We expect these ongoing productivity and cost containment actions will continue to benefit consolidated margins in 2025.

"Our strong operational results were complemented by our ongoing portfolio actions. We have completed six acquisitions over the last three years to create a new platform in cryogenic components within our Clean Energy & Fueling segment, and we are very excited about the future value creation through margin expansion and durable, secular end market growth. We recently closed two bolt-on acquisitions within our high-priority Pumps & Process Solutions segment, and our acquisition pipeline remains robust. We ended the year with a significant cash position that provides flexibility as we pursue value-creating capital deployment to further expand our businesses in high growth, high margin priority platforms.

"We are optimistic about 2025. Underlying demand trends remain solid across the portfolio, as evidenced by our order momentum, and we have significant runway for continued margin improvement through positive mix benefits and numerous cost and performance levers. We have high confidence in Dover’s attractive end market exposures, flexible business model, and proven execution playbook. With this backdrop, we are poised to deliver double-digit EPS growth in 2025 through a combination of accretive top line growth, margin improvement, and value-creating capital allocation."

FULL YEAR 2025 GUIDANCE:

In 2025, Dover expects to generate GAAP EPS from continuing operations in the range of $8.16 to $8.36 (adjusted EPS from continuing operations of $9.30 to $9.50), based on full year revenue growth of 2% to 4% (organic growth of 3% to 5%).

CONFERENCE CALL INFORMATION:

Dover will host a webcast and conference call to discuss its fourth quarter and full year 2024 results at 9:00 A.M. Eastern Time (8:00 A.M. Central Time) on Thursday, January 30, 2025. The webcast can be accessed on the Dover website at dovercorporation.com. The conference call will also be made available for replay on the website. Additional information on Dover's results and its operating segments can be found on the Company's website.

ABOUT DOVER:

Dover is a diversified global manufacturer and solutions provider with annual revenue of over $7 billion. We deliver innovative equipment and components, consumable supplies, aftermarket parts, software and digital solutions, and support services through five operating segments: Engineered Products, Clean Energy & Fueling, Imaging & Identification, Pumps & Process Solutions and Climate & Sustainability Technologies. Dover combines global scale with operational agility to lead the markets we serve. Recognized for our entrepreneurial approach for over 70 years, our team of approximately 24,000 employees takes an ownership mindset, collaborating with customers to redefine what's possible. Headquartered in Downers Grove, Illinois, Dover trades on the New York Stock Exchange under "DOV."

FORWARD-LOOKING STATEMENTS:

This press release contains "forward-looking" statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. All statements in this document other than statements of historical fact are statements that are, or could be deemed, "forward-looking" statements. Forward-looking statements are subject to numerous important risks, uncertainties, assumptions and other factors, some of which are beyond the Company's control. Factors that could cause actual results to differ materially from current expectations include, among other things, general economic conditions and conditions in the particular markets in which we operate; supply chain constraints and labor shortages that could result in production stoppages; inflation in material input costs and freight logistics; the impacts of natural or human-induced disasters, acts of war, terrorism, international conflicts, and public health crises on the global economy and on our customers, suppliers, employees, business and cash flows; changes in customer demand and capital spending; competitive factors and pricing pressures; our ability to develop and launch new products in a cost-effective manner; changes in law; our ability to identify, consummate and successfully integrate and realize synergies from newly acquired businesses; acquisition valuation levels; the impact of interest rate and currency exchange rate fluctuations; capital allocation plans and changes in those plans, including with respect to dividends, share repurchases, investments in research and development, capital expenditures and acquisitions; our ability to effectively deploy capital resulting from dispositions; our ability to derive expected benefits from restructurings, productivity initiatives and other cost reduction actions; the impact of legal compliance risks and litigation, including with respect to product quality and safety, cybersecurity and privacy; and our ability to capture and protect intellectual property rights. For details on the risks and uncertainties that could cause our results to differ materially from the forward-looking statements contained herein, we refer you to the documents we file with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the year ended December 31, 2023, and our Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. These documents are available from the Securities and Exchange Commission, and on our website, dovercorporation.com. The Company undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise.